Outsource Accounts Reconciliation Services

Accounts Reconciliation is a time-consuming process that can lead to errors and cost you valuable money and time if not done correctly. It is the process of comparing and verifying two sets of documents, which makes it an essential step in any accounting cycle that helps to maintain accuracy, integrity, and efficiency while preventing errors from occurring.

With Outsourcing Business Solutions (OBS), you can be sure your financial records are accurate with our full-service reconciliation services. We’ll review everything carefully line-by-line until it’s balanced according to company policy guidelines, so nothing important goes unnoticed.

AWARD-WINNING OUTSOURCING COMPANY

Simplify Your Accounts Reconciliation with Expert Solutions

From there, we can help you investigate more complex issues if need be – whether they’re related to tax payment due dates, incorrect entries made during manual data entry sessions, discrepancies found on vendor invoices versus purchase orders issued, etc. Our experts have seen them all!

Through our years of experience working in this space, OBS understands how having reliable access to clean numbers allows businesses to make smarter decisions about their budget allocations, which ultimately drives business success forward.

That’s why investing in a quality reconciliation service would not only increase accuracy but also free up resources needed for other operational tasks, giving clients valuable time and peace of mind knowing their books are taken care of at all times.

Get a FREE QUOTE!

Accounts Reconciliation Services for Multiple Industries

We Support Multiple Accounting Software

People Love Working With Us

Process of Reconciliation Services

Determine which accounts, such as bank accounts, credit card statements, vendor statements, or general ledger accounts, need to be reconciled.

Gather the appropriate financial records for the accounts that need to be reconciled, such as bank statements, invoices, receipts, and other supporting data.

Evaluate the balances or transactions shown in the company’s general ledger or books against information obtained from outside sources, such as bank or vendor statements. Between the two sets of records, look for any discrepancies or differences.

Examine the discovered discrepancies and look into the causes. This can entail tracking down transactions, checking computations, or getting in touch with outside parties to get further information. Take the required actions to address the disparity after the reason has been identified. To address any differences, this may entail fixing errors, amending entries, or getting in touch with the concerned parties.

After locating and resolving errors, correct the company’s financial records as required. To ensure that the accounts are accurate and in line with the reconciled data, this may entail correcting changes, revising account balances, or recording extra entries.

Check the reconciled accounts to make sure that all errors have been properly handled and corrected. For future reference and auditing needs, record the reconciliation procedure and any modifications that were made.

To guarantee continued accuracy and consistency of financial data, perform reconciliations on a regular basis, such as monthly or quarterly. This makes it easier to quickly spot mistakes or fraudulent activity.

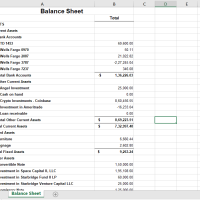

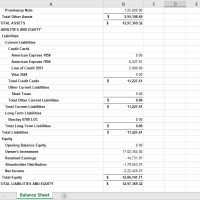

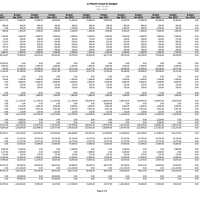

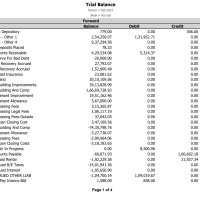

Our Accounting Portfolio

Outsource Account, Bank and Credit Card Reconciliation Services

Outsourcing accouts, bank and credit card reconciliation is becoming popular with CPA and accounting firms. Watch our video below to know how a professional company like OBS can help you in saving your time and efforts

Our team of expert accountants and bookkeepers can take care of your bank and credit card reconciliations for you, so you can free up your time and energy to focus on what you do best. We use the latest technology and software to ensure that your records are always accurate and up-to-date. Plus, our team has years of experience in reconciling bank and credit card statements, so we can catch any discrepancies quickly and efficiently.

Why Companies Like Yours Choose to Outsource Their Account Reconciliation With OBS

OBS is a specialized accounting service provider with a committed team of reconciliation specialists. Companies can benefit from our specific knowledge and experience in managing various types of reconciliations by outsourcing reconciliation to OBS. Our staff guarantees accuracy and speed in the reconciliation process by staying up to date with industry best practices.

Companies can save a lot of money by outsourcing reconciliation to OBS. Companies can benefit from OBS’s cost-effective solutions rather than employing and training internal reconciliation specialists or committing current resources to this activity. Depending on the unique reconciliation requirements of each organization, we can offer flexible price structures and tailor our services accordingly.

Businesses can benefit from increased efficiency and quicker turnaround times when OBS handles the reconciliation process. In order to offer accurate findings within predetermined deadlines, our team makes use of cutting-edge reconciliation tools, technology, and simplified processes. This enables businesses to quickly obtain reconciled data, supporting better financial management and decision-making.

Businesses can refocus their internal resources on their core business functions by outsourcing reconciliation to OBS. Employees may now focus on strategic tasks that promote growth and profitability, which boosts productivity. When OBS handles the reconciliation tasks, accuracy and compliance are guaranteed and internal resources are freed up.

The reconciliation services offered by OBS are both scalable and flexible. Regardless of how much a company’s reconciliation volume changes or increases over time, we can modify our resources to meet shifting demands. This alleviates worries about running out of resources at busy times or needing to hire more staff to handle transient staffing spikes in reconciliation.

OBS places a high value on secrecy and data security. To safeguard customer information and guarantee compliance with data protection laws, we have strong security measures in place. Our clients can rest easy knowing that their sensitive financial information is well-protected thanks to our secure infrastructure, data encryption processes, restricted access controls, and frequent security assessments.

OBS is aware that every business has different requirements for reconciliation. We provide specialized solutions made to fit the unique requirements of our customers. Our team works directly with businesses to comprehend their reconciliation systems, procedures, and desired results. This ensures that the OBS reconciliation services are in line with the processes and business goals of the client.

At OBS, we value open and honest communication with our customers. In order to offer updates on the reconciliation process, swiftly respond to any questions or concerns, and gather feedback for ongoing development, we maintain regular contact channels. Our committed support team is always on hand to help customers and offer assistance as needed.

OBS makes investments in cutting-edge technology and software for reconciliation. Companies can acquire these capabilities without incurring additional costs by outsourcing reconciliation to us. Our technology-driven methodology boosts precision, automates repetitive operations, and lowers the possibility of errors, leading to reconciliations that are more trustworthy and effective.

Rectification is a crucial step in detecting and reducing financial risks. OBS is well-versed in legal specifications and compliance benchmarks. Companies may guarantee compliance with accounting rules, lower their risk of fraud, and keep accurate and open financial records by outsourcing reconciliation to us.

OBS has a staff of knowledgeable reconciliation specialists, which enables us to manage reconciliation projects of various intensities and complexity. OBS can scale up or down resources as needed, guaranteeing efficient and prompt delivery of reconciliations regardless of how much or how little work a company has to be done on reconciliation or if it needs to be done for several accounts across various entities.

OBS is devoted to improving processes continuously. We evaluate and improve our reconciliation procedures frequently to increase their effectiveness, precision, and quality. Companies that outsource reconciliation to us gain from our commitment to streamlining and improving reconciliation processes, which results in continuous improvements to the reconciliation process.

Reconciliations that are accurate and current give businesses a comprehensive picture of their financial situation. Due to OBS’s expertise in reconciliation, we can offer analytical analyses and reports that point out potential financial risks. This enables businesses to make decisions based on facts, find ways to cut costs, and maximize financial performance.

Financial audits and regulatory compliance both depend on reconciliation. Companies can ensure their financial records are well-prepared for audits by outsourcing reconciliation to OBS. Our precise and thoroughly documented reconciliations simplify the audit procedure and show compliance, leading to more pleasant audit experiences and fewer disruptions because of audits.

OBS is dedicated to providing top-notch customer service. With each of our clients, we create clear service level agreements (SLAs) that specify the expected standards of performance, delivery dates, and deliverables for our reconciliation services. Our devoted support staff is always on hand to respond to any inquiries, offer guidance, and guarantee a seamless outsourcing experience.

OBS has a demonstrated history of serving clients from a range of sectors with reconciliation services. We can supply specialized solutions because of our knowledge and expertise in recognizing the distinct reconciling needs of various industries. Positive client comments and referrals serve as strong evidence of our commitment to our client’s satisfaction and long-term cooperation.

Client's Testimonials

Watson, CEO

OBS's reconciliation services are second to none. Their team is knowledgeable, responsive, and committed to our success. We couldn't be happier with their work.

Martin, CMO

We've been able to improve our financial transparency, accountability thanks to Outsourcing Business Solutions reconciliation services.

Eddie, Co-Founder

OBS's reconciliation services have allowed us to be more efficient with our financial operations. We've been able to improve the accounting costs and focus on growing our business.

Peter, Manager

OBS's reconciliation services have helped us to streamline our accounting processes and make better financial decisions. They're a valuable partner for our business.

Larry, Co-Founder

Outsourcing Business Solutions's reconciliation services have been instrumental in helping us to keep our finances organized and compliant.

Louis, Manager

We've been able to improve our cash flow management and reduce the risk of fraud thanks to OBS's reconciliation services.

FAQs

Reconciliation outsourcing entails paying a third-party service provider to manage the reconciliation procedure on the client’s behalf. Reconciling bank accounts, vendor statements, intercompany transactions, or other financial documents may fall under this category.

Businesses may outsource reconciliation for a number of reasons, including cost savings, access to specialized knowledge, increased productivity, and the chance to concentrate on core business operations. Outsourcing can also offer scaling and flexibility in addressing fluctuating reconciliation volumes.

Bank account reconciliations, credit card reconciliations, accounts payable and receivable reconciliations, inventory reconciliations, general ledger reconciliations, and intercompany reconciliations are just a few of the different types of reconciliations that can be outsourced.

Consider criteria including experience and knowledge, reputation, client recommendations, security precautions, data protection policies, service level agreements (SLAs), and cost-effectiveness when choosing a reconciliation outsourcing provider. It’s crucial to carefully assess the available providers and select one that suits your unique requirements.

Reconciliation outsourcing has a number of advantages, including the ability to concentrate on core business operations and cost savings due to reduced staffing and infrastructure needs, access to specialized reconciliation tools and technologies, increased accuracy and efficiency, quicker turnaround times, improved data security and compliance, and access to specialized reconciliation tools and technologies.

The provider and the predetermined terms will determine the specifics of the outsourcing reconciliation process. Typically, this entails securely exchanging financial information and accompanying documentation with the supplier, who will then carry out the required reconciliations utilizing their resources, skills, and procedures. Any differences or problems will be communicated to the business, and the two parties will work together to find solutions.

Select a reliable outsourcing firm with effective security measures in place to guarantee data protection and confidentiality. This may involve employing secure data transmission methods, limiting access, encrypting data, conducting frequent security audits, and adhering to applicable data protection laws.

Yes, reconciliation services can frequently be modified to meet the demands of your business via outsourcing. The outsourced provider ought to collaborate extensively with you to comprehend your needs for reconciliation and create a plan that fits your procedures and workflows.

Reconciliation outsourcing varies in price depending on a number of variables, including the volume and complexity of reconciliations, the range of services needed, and the outsourced provider’s fee schedule. When assessing the total cost-effectiveness of outsourcing, it’s crucial to take into account the possible cost savings, efficiency improvements, and increased accuracy.

Establish open lines of communication with the outsourcing provider, spell out expectations and deliverables in the service agreement, offer thorough documentation and access to pertinent systems, and conduct regular check-ins and performance reviews to address any problems or concerns as soon as they arise to ensure a smooth transition.