Outsource CFO Services

Outsourcing Business Solutions, your trusted partner in CFO services for businesses of all sizes. We are here to lighten your load and assist you in thriving in today’s cutthroat environment since we recognize that financial management is an essential component of any firm.

At Outsourcing Business Solutions, we are experts in offering thorough CFO services that are customized to fit your unique requirements. Our knowledgeable team of CFO professionals is prepared to help you every step of the way, whether you’re a startup trying to build a strong financial foundation or an existing business looking to optimize your financial strategies.

AWARD-WINNING OUTSOURCING COMPANY

With years of financial management experience in a variety of industries, we have a comprehensive understanding of the opportunities and problems that businesses confront in today’s fast-paced market. To produce outcomes that are unmatched, we combine this experience with state-of-the-art technology and a client-centric strategy.

When you work with Outsourcing Business Solutions, you have access to a committed team of CFO specialists who will collaborate directly with you to create and implement plans that promote growth, improve profitability, and guarantee long-term financial viability. Our services cover a broad range of topics, such as budgeting and forecasting, cash flow management, risk analysis, financial reporting, and much more.

We take pride in providing our clients with outstanding value. By delegating your CFO duties to us, you can make use of our vast resources and market knowledge, freeing up your time to concentrate on your main business operations and strategic goals. Our adaptable engagement models make sure you get the level of assistance that best meets your needs, whether it’s continuous or just for certain projects.

Transparency, integrity, and secrecy are important to us as a reliable partner. We take the utmost care with your financial information and make sure that it complies with all legal obligations. Our team stays current on the most recent market trends and best practices, allowing us to offer you proactive guidance and creative solutions that advance your company.

Discover the difference a qualified CFO service can make for your company. Reach out to Outsourcing Business Solutions right away, and let us help you improve your financial management. Together, we’ll lay a strong foundation for your success, provide you with practical knowledge, and unleash the full potential of your company.

Get a FREE QUOTE!

CFO Services We Offer

- Financial Planning and Analysis

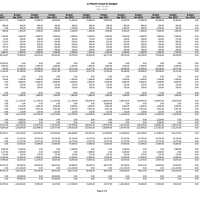

- Budgeting and Forecasting

- Cash Flow Management

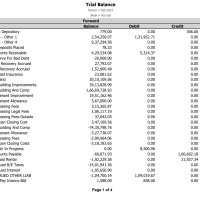

- Financial Reporting

- Risk Assessment and Management

- Cost Management and Profitability Analysis

- Financial Systems and Technology

- Strategic Financial Advice

- Investor Relations and Fundraising

- Financial Compliance and Governance

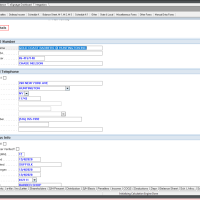

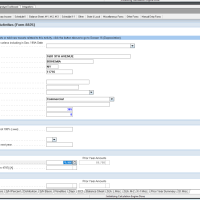

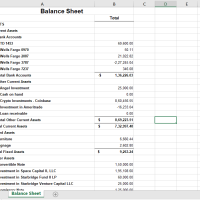

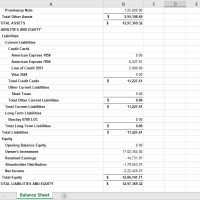

Our Accounting Portfolio

CFO Services for Multiple Industries

We Support Multiple Accounting Software

People Love Working With Us

Why Companies Like Yours Choose to Outsource Their CFO Services With OBS

Our team of CFO specialists provides years of experience and a lot of knowledge of financial management across a variety of sectors. Complex financial issues have been effectively managed by us, and we have provided our clients with quantifiable outcomes. Partnering with us gives you access to this in-depth knowledge and a team that is familiar with the nuances of your sector.

We provide specialized CFO services that are catered to the requirements of your company. We take the time to comprehend your company, its financial goals, and the places where support is needed. With this individualized approach, we can guarantee that our solutions will complement your strategic goals.

For many organizations, especially smaller ones, hiring a full-time CFO can be a considerable financial commitment. You may get top-notch financial expertise at a fraction of the cost by outsourcing your CFO duties to us. All sizes of organizations can benefit from this cost-effective solution because of our adaptable engagement models, which let you increase the level of help based on your needs.

As a business owner or CEO, it is best to devote your time and resources to fundamental tasks that stimulate innovation and growth. You can free up critical resources and concentrate on what you do best by giving us the responsibility of handling your CFO duties. We take care of complicated financial issues so you can focus on long-term goals and day-to-day tasks.

Outsourcing Business Solutions uses state-of-the-art tools and technology to increase the effectiveness and accuracy of our CFO services. We stay up to date with the most recent financial software, analytics tools, and reporting systems to make sure you have access to timely information and data that can be used to make wise decisions.

Our CFO consultants offer proactive advice and strategic direction in addition to crunching numbers for your company. We provide proactive advice and strategic direction in addition to doing ordinary financial responsibilities. We assist you in finding possibilities for growth, reducing risks, maximizing cash flow, and making wise financial decisions that advance your company.

We are aware of the sensitivity of financial data and the need of protecting confidentiality. Your financial information will be treated with the utmost care thanks to the strong data security measures that our staff follows. To keep your firm compatible with all pertinent rules and regulations, we also keep up with regulatory changes and compliance needs.

Your finance requirements may vary as your organization develops and expands. We provide scalability and flexibility to meet your changing needs, whether you need short-term assistance during a busy time, help with a particular project or continuous CFO services. Our team can adjust to the shifting demands of your company with ease, making sure you always have the appropriate degree of financial support.

We can connect your company to beneficial networks and opportunities through our vast network of corporate connections and strategic alliances. We can use our connections to support you in achieving your goals, whether you need aid with fundraising, gaining access to financing, or increasing your market reach. Our extensive network enhances the value we provide as your dependable CFO service provider.

We provide new perspectives and fresh insights that can reveal untapped opportunities or spot potential problems that may have gone unnoticed. We can generate data-driven recommendations with a favorable effect on your bottom line thanks to our impartial perspective.

New trends, laws, and technology are continually emerging as the financial world changes. Our company, Outsourcing Business Solutions, is dedicated to ongoing learning and development. We prioritize delivering the most current and relevant financial expertise to our clients. To ensure this, our team stays up-to-date on market developments, actively participates in training sessions, and engages in continuous professional development activities.

Integrating a new service provider seamlessly into your current business procedures can be a problem. Outsourcing Business Solutions, on the other hand, places a premium on smooth integration and offers ongoing assistance throughout the partnership. Our team collaborates successfully with your internal stakeholders to achieve a seamless transition and reduce disruptions. We are always available to immediately resolve any queries or worries you may have.

Our history speaks for itself. From start-ups to well-established companies of all sizes, we have successfully served companies in a variety of industries. Our pleased clients attest to the benefit our CFO services provide to their companies. We take great pride in our accomplishments and are prepared to work with your company with the same level of commitment, knowledge, and success.

Client's Testimonials

Wick, CEO

Our business has seen significant growth and success since partnering with OBS. Their CFO services have been instrumental in our success., providing us with the financial expertise and support we need to thrive.

Morris, CMO

We've been able to focus more on our core business activities thanks to OBS's CFO services. They handle all of financial reporting, analysis, which frees up our time and resources.

John, Co-Founder

OBS's CFO services have transformed the financial health of our business. Their expert guidance and strategic planning have helped us to maximize profits and make smarter financial decisions

Wilson, Manager

OBS's CFO services are an excellent value for our business. They provide us with the same level of expertise and support as an in-house CFO., but without the overhead costs.

Veronica, Co-Founder

Working with OBS's CFOs has been a pleasure. They're professional, responsive, and always willing to go above and beyond to help us achieve our financial goals

Rosey, Manager

OBS's CFO services have helped us to manage financial risks and make more informed decisions. Their insights and analysis have been invaluable to our business. .

FAQs

Entrusting your company’s financial management operations to an outside service provider is a smart strategic move. To manage diverse financial chores, offer strategic direction, and guarantee your firm makes solid financial decisions, it entails engaging a team of seasoned CFO professionals who work remotely.

CFO outsourcing services frequently cover a broad spectrum of financial management tasks. These may include cash flow management, risk assessment, financial reporting, cost optimization, budgeting and forecasting, financial planning and analysis, cost optimization, strategic financial counseling, financial process improvement, and more. Based on the specific needs of your company, the given services can be modified.

The benefits of outsourcing CFO services are numerous. It offers access to knowledgeable financial expertise without the expense of paying for a full-time CFO. Businesses can increase financial decision-making, increase cost-effectiveness, obtain strategic insights, and assure financial regulation compliance while concentrating on their core company operations. Additionally, scaling, flexibility, and access to cutting-edge financial instruments and technology are all benefits of outsourcing.

For your company to succeed, selecting the best outsourcing CFO service provider is essential. Consider factors like their knowledge of the sector, track record, customer recommendations, variety of services provided, technological prowess, scalability, and cultural fit. Additionally, it’s crucial to hold in-depth discussions and assessments to make sure the provider is capable of providing customized solutions and is aware of the objectives of your company.

No, CFO outsourcing services are appropriate for all sizes of firms. Outsourcing can have a lot of advantages, regardless of how big or small your business is. Outsourcing is frequently useful for smaller organizations because it gives them access to high-level financial expertise that may not be possible to have in-house due to cost restrictions.

An initial meeting to ascertain the needs of your company is usually followed by a thorough analysis and proposal from the service provider. Following the conclusion of the engagement, the supplier will work closely with your team to collect pertinent financial information and start delivering the services that were previously agreed upon. Transparency and alignment are maintained throughout the outsourcing arrangement through regular reporting and communication.

In outsourcing CFO services, data security, and confidentiality are of the utmost significance. To protect client data, reputable service providers use strong security procedures. These consist of encrypted communication channels, secure data transmission, access controls, and adherence to data protection laws. To secure the safety of your financial data, it is crucial to negotiate and clarify security procedures with the outsourcing provider.

In terms of interaction approaches, outsourcing CFO services really gives flexibility. Depending on your company’s demands, you can tailor the level of outsourcing, whether it be the total outsourcing of all financial operations or just particular projects or activities. The service provider must be able to customize their offerings to your needs and offer scalable solutions as your company grows.

For a number of reasons, outsourcing CFO services can be more affordable than hiring an internal CFO. By outsourcing, you can save money on costs like the full-time CFO’s salary, perks, office space, and training. Additionally, outsourcing gives you the flexibility and cost control you need by letting you pay only for the precise services you require. For small and medium-sized firms in particular, it may be a more cost-effective option.

Your needs can determine the extent of the outsourced CFO’s involvement. Depending on what you need, they might be as active or as advisory-focused. Some companies favor a more team-oriented strategy, where the CFO collaborates closely with internal teams, participates in meetings, and offers strategic direction. Some people might prefer a more independent strategy where the CFO is solely responsible for offering financial analyses and suggestions. With the outsourcing company, the extent of involvement can be negotiated and decided.

Yes, a contracted CFO can be very important for fundraising and financial planning. They can offer insightful knowledge and experience to aid in the creation of a solid financial plan, the optimization of your capital structure, and the communication of financial information to potential lenders or investors. Additionally, they may help with financial modeling, due diligence, and the creation of financial predictions and statements that support your fundraising goals.

The length of time it takes for an outsourced CFO to begin working with your company can change depending on your unique needs and the service provider’s availability. It’s crucial to express your preferred timeline throughout the preliminary conversations. The outsourcing provider would normally try to start working with your company as soon as the engagement is finalized, ensuring a seamless transfer and integration.

Yes, an outsourced CFO may collaborate easily with your current financial and accounting teams. They can work together, offer direction, and improve your company’s overall financial management. The external CFO may add their knowledge and experience to your internal team’s abilities, adding a further level of assistance and strategic insight.

Businesses experience changes as they develop over time. It’s crucial to inform the outsourcing provider of any changes to your company that may affect the required CFO services. They can evaluate the revised specifications and modify the services offered as necessary. The outsourcing provider needs to be versatile and flexible to meet your changing demands and guarantee ongoing support.

The effectiveness and success of outsourcing CFO services can be evaluated using a variety of metrics and indicators. Improvements in financial performance, cost savings realized, timely and accurate financial reporting, effective use of financial strategies, and client pleasure are a few examples. The effectiveness and value of the outsourced CFO’s services can be assessed through regular performance evaluations, talks, and agreed-upon key performance indicators (KPIs).