Payroll Outsourcing Services

Outsourcing Business Solutions (OBS), your trusted partner for comprehensive payroll services. We recognize that handling payroll can be a time-consuming and complex activity that diverts you from your primary organizational goals. We can help your business succeed by relieving you of the strain of payroll in this situation.

With OBS Payroll Services, you have access to a team of payroll specialists who are knowledgeable about the most recent market trends and state-of-the-art technologies. Our objective is to supply accurate and timely payroll solutions that are in line with your particular business objectives while streamlining your payroll procedures and ensuring compliance.

AWARD-WINNING OUTSOURCING COMPANY

Simplify Your Payroll with Expert Solutions

Imagine the freedom of leaving the difficulties of payroll management to us and concentrating on what really counts – nurturing client connections, fostering innovation, and boosting your bottom line. Our knowledgeable staff is skilled in handling all payroll-related tasks, including precise calculations, deductions, tax filings, and regulatory compliance. With our dedication to accuracy and care for the little things, you can rest easy knowing that your payroll is in good hands.

However, OBS offers more than just payroll services. As your strategic partner, we are dedicated to learning about your company’s objectives and molding our services to assist you in achieving them.

We provide insightful analysis and thorough reporting that go beyond the numbers to give you the power to make wise decisions and improve your financial plan.

Join forces with OBS to take the first step toward superior payroll management. To learn how our specialized payroll solutions may help your company soar to new heights, get in touch with us right away. Let’s work together to create a prosperous future, one payslip at a time.

Get a FREE QUOTE!

Payroll Outsourcing Services for Multiple Industries

We Support Multiple Accounting Software

People Love Working With Us

Process of Payroll Services

The first step in the procedure is to precisely record and monitor each employee’s working hours and attendance. Manual timesheets, electronic time clocks, or digital time-tracking systems can all be used to do this. During this phase, employees may also submit time off, vacations, or sick leave.

Following the collection of time and attendance data, it is assembled and accuracy checked. Additionally, pertinent data are acquired on the employee’s personal information, tax withholdings, and deductions. Payroll calculations are based on this information.

Payroll administrators or software programs compute each employee’s gross pay using the data that has been gathered. This normally includes regular salary or salaries, as well as any appropriate bonuses, commissions, overtime pay, and other revenues.

After calculating the gross pay, the amount is reduced by deductions and withholdings. Federal, state, and municipal taxes, social security contributions, medical insurance premiums, retirement contributions, and any other permitted deductions are examples of these deductions.

The next step in this process is calculating net pay. After deducting all deductions and withholdings from the employee’s gross pay, the net pay is the amount that remains. It represents the amount that will really be paid to the employee.

After determining the net pay, payroll administrators process the payroll by creating paychecks or starting direct transfers into workers’ bank accounts. Each payroll period’s accurate records and paperwork, such as pay stubs and payroll reports, are kept.

Payroll departments are in charge of submitting payroll taxes to the relevant government bodies. Payroll taxes due by the employer, employee earnings, and income tax withholdings are all included in this. Regularly submitted tax forms include Form 941 for federal taxes among others.

Complying with tax laws, labour laws, and other rules pertaining to payroll is an essential component of the payroll process. In order to avoid fines or legal troubles, it is crucial to stay informed of legislative changes and to ensure compliance.

Reconciliation of payroll transactions entails confirming the accuracy and balance of all financial transactions pertaining to payroll. This involves creating financial reports pertaining to payroll expenses as well as balancing payroll accounts, and checking tax deposits.

Payroll Processing Services We Offer

Outsourcing payroll processing services is a great way to save time and money. There are numerous payroll services available, each with a special set of features. Here are the payroll outsourcing services offered by OBS:

Create Payroll and Pay Scale

Maintain monthly payroll and master data based on input received from clients and provide various output reports based on employee and manager requirements.

Reimbursement Management

Visa is a permit issued by a foreign embassy or consulate to allow entry into a specific country. Visas are generally valid for a set amount of time and are only good for travel purposes.

Prepare Returns for State and Federal Agencies

We prepare and submit all statutory returns to government agencies, as required. We perform necessary activities to collect and verify proof of investment at the end of each year.

Statewide Annual, Quarterly, and Monthly Documents

We manage financial reporting, expenses, balances, accruals, and approval of employee terminations. We interact with authorities regarding the registration of your business such as Income Tax, Employment, Provident Fund, ESIC, and Business Tax Authorities.

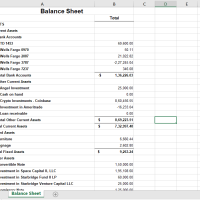

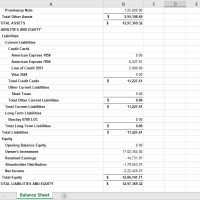

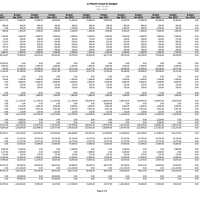

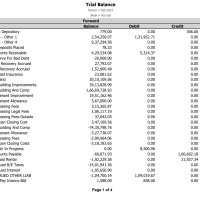

Our Accounting Portfolio

Why Companies Like Yours Choose to Outsource Their Payroll With OBS

OBS specializes in payroll management and has an in-depth understanding of best practices, tax laws, and payroll regulations. By outsourcing your payroll to OBS, you have access to a team of knowledgeable experts who stay current with market developments and guarantee adherence to legal requirements.

Payroll outsourcing with OBS can help your business save a lot of money. You can save money on hiring and training costs, payroll software and technology expenditures, and continuing payroll administration costs by doing away with the requirement for an internal payroll department. OBS provides customizable price options that are suited to your unique requirements, ensuring affordability.

Processing payroll can take a lot of time, especially for companies with complicated payroll obligations or a sizable workforce. Your HR and finance teams may concentrate on key projects and core business operations by outsourcing payroll to OBS, which will save them important time and boost productivity overall.

Fixing payroll mistakes and rules’ non-compliance can be expensive and time-consuming. The administration of benefits, as well as tax withholdings, deductions, and payroll calculations, are all accurately handled by OBS. Our proficiency in payroll compliance lowers the possibility of mistakes, fines, and legal problems.

OBS gives data security and secrecy top priority. To protect sensitive employee information, we have stringent controls over access, secure data transmission, and adherence to industry standards in place. You can be sure that your payroll information is secure and treated with the utmost discretion.

OBS delivers scalability and flexibility to meet your evolving payroll requirements as your organization expands or suffers changes in employee numbers. We can quickly adapt to new departmental or geographic setups, increased payroll volume, and additional staff needs.

To improve reporting capabilities and optimize the payroll process, OBS uses advanced payroll software and technology. Our cutting-edge solutions offer precise and thorough payroll reports that are tailored to your needs and give insightful information about your payroll costs, tax liabilities, and employee information.

OBS offers first-rate payroll-related employee support. Our committed team is available to immediately and professionally respond to employee inquiries, ensuring a great employee experience. Additionally, we provide self-service websites where workers may examine their pay stubs, access their payroll information, and change their personal information.

By outsourcing your payroll to OBS, you can be sure that experienced professionals are handling it. We place a high priority on accuracy, compliance, and timely payroll processing to ensure dependable and consistent payroll services.

By outsourcing payroll to OBS, you can put more of your attention toward your strategic goals, core business operations, and client pleasure. By giving us the responsibility for managing your payroll, you can devote more time and money to expanding your company and accomplishing your organizational objectives.

From timekeeping to paying employees, OBS streamlines the whole payroll procedure. We manage all facets of payroll administration, including figuring up employee hours, processing benefits and deductions, creating paychecks or direct payments, and publishing payroll reports. Your payroll processes are streamlined, saving you time and easing your administrative workload.

At OBS, we understand that every company has distinct payroll requirements. That’s why we offer tailored payroll solutions that cater to your specific needs. We can create a payroll system that meets your requirements and ensures accuracy, whether you have workers with various pay systems, several locations, or complex payroll circumstances.

When processing payroll, accuracy is crucial. To reduce errors and guarantee accurate calculations, OBS uses sophisticated payroll software and validation methods. You can considerably lower the chance of expensive errors, such as improper tax withholdings or inaccurate employee remuneration, by outsourcing your payroll to us.

It’s essential for any firm to maintain compliance with tax laws. All payroll-related tax filings, such as federal, state, and local tax returns, are handled by OBS. We guarantee on-time tax forms, deposits, and payment submissions, lowering the possibility of fines or late fees related to payroll tax compliance.

By outsourcing your payroll to OBS, you have access to a team of payroll specialists who are well-versed in best practices and government guidelines. In order to give you reliable advice and guarantee that your payroll procedures comply with the most recent regulations, our professionals keep up with industry changes and changing payroll rules.

OBS offers full payroll reporting, providing you with a detailed picture of your payroll costs and financial insights. With the help of our thorough reports, which break down wages, taxes, deductions, and other aspects of payroll, you can evaluate payroll data, spot trends, and make wise financial decisions.

By entrusting OBS with the management of your payroll, you can relax knowing that unforeseen circumstances or natural disasters won’t affect your payroll operations. Even in the face of unforeseen circumstances, we have backup systems and contingency plans in place to guarantee the continuation of payroll processing.

OBS takes great pride in providing excellent customer service. All of your payroll questions and issues will receive timely, competent, and dependable service from our team. In order to ensure that our client’s payroll needs are addressed with the highest care and attention, we work hard to develop lasting relationships with them.

Client's Testimonials

Nathalia, CEO

OBS's payroll services are an excellent value for our business. We've been able to save money and reduce the risk of payroll errors by outsourcing to their team.

Chrish, CMO

Working with OBS's payroll team has been a pleasure. They're easy to communicate with, and they always keep us informed of any payroll changes or updates.

Alex, Co-Founder

They handle everything from tax filings to direct deposits, which has simplified our payroll process and reduced errors.

Paul, Manager

OBS's payroll services have allowed us to focus on what we do best: running our business. We don't have to worry about the administrative burden of payroll processing anymore.

Larry, Co-Founder

We've saved a lot of time and hassle by outsourcing our payroll to OBS. Their services are efficient and cost-effective, and we can always count on them to deliver on time.

Richard, Manager

Their accurate and timely processing has ensured that our employees are always paid on time, which has boosted morale and productivity.

FAQs

Payroll outsourcing is when a specialist company manages your payroll to ensure that your employees are paid correctly each month and on time. It starts with preparing a list of paid employees and ends with recording those expenses by the outsourcing company. It’s a complicated process that requires different teams like payroll, HR, and finance to work together.

The advantages of outsourcing payroll services include cost savings, time savings, accuracy, knowledge of compliance requirements, and access to cutting-edge payroll software and technology. It enables you to concentrate on your main business operations while entrusting skilled experts with the challenging task of managing payroll.

Yes, trustworthy payroll service companies put data security first. They put in place rigorous access controls, encrypted data transmission, and protected data storage, among other effective security measures. Selecting a reputable company with a track record of data protection is crucial.

Yes, outsourcing payroll services can aid in ensuring that payroll rules are followed. Professional payroll service providers keep abreast of shifting legal requirements, tax rates, and reporting standards. Due to their experience managing payroll taxes, deductions, and files, there is a lower chance of compliance mistakes and fines.

Gathering relevant employee information from the client, such as hours worked and wages, is a typical step in the payroll outsourcing process. When payroll calculations are complete, including taxes, deductions, and withholdings, the provider generates checks or direct deposits. They manage tax filings, provide reports, and give clients the required paperwork.

Yes, skilled payroll service providers are capable of managing intricate payroll needs. They can accommodate different payment frequencies, deal with diverse forms of compensation, control deductions and perks, and take care of industry-specific requirements. They collaborate closely with clients to customize the payroll procedure to meet their specific needs.

Yes, trustworthy payroll service companies give customers access to thorough payroll records and information. This comprises tax returns, payroll registrations, payroll summaries, and year-end paperwork. You can track payroll costs using this information, analyze statistics, and make wise judgments.

By outsourcing payroll, you may save your HR and finance departments considerable time by doing away with the requirement for internal payroll processing. It lessens the administrative work involved with processing direct deposits, keeping up with payroll standards, handling tax liabilities, and calculating payroll.

Yes, experts in payroll management with vast expertise and training work for professional payroll service providers. To assure accurate computations and lower the possibility of errors, they use cutting-edge software and technology. Payroll accuracy is increased and errors are reduced when payroll is outsourced to professionals.

Payroll service outsourcing offers scalability to meet workforce expansion or volatility in your organization. To accommodate changes in payroll volume, new locations, and employee onboarding or offboarding, payroll services may readily adapt.

Yes, a lot of payroll service providers give employees specialized support for questions about payroll, tax withholdings, and paycheck issues. They act as a trustworthy resource, immediately responding to employee inquiries, and ensuring that your staff members have a positive payroll experience.